How did Nightlight begin?

Nightlight Insurance Agency’s story began in 2009 when Brett Dyer was hired by Greenway Insurance to establish a branch in Austin, TX. Over the next 13 years, Brett honed his expertise in the insurance industry, helping more than 3,000 clients safeguard their assets by expertly matching them with the best coverage options from over 40 different companies. His dedication to delivering value and personalized service laid the foundation for something greater. In April 2022, Brett took the next step in his journey, becoming the CEO and Founder of Nightlight Insurance Agency, where his commitment to protecting clients continues.

Why did we choose the name Nightlight?

Nightlight Insurance is a metaphor that aligns with the core values and mission of providing security, comfort, and peace of mind to our clients. Just as a nightlight offers comfort and protection in the dark, our agency serves as a reliable guide, offering assurance and support when our clients need it most.

At Nightlight, we take pride in our deep local expertise and personalized service. You’ll never have to deal with a distant call center to understand your coverage, request a rate review, or seek advice on filing a claim. With your dedicated agent at Nightlight, you have a reliable source of guidance—always present, always dependable. Like a nightlight that illuminates the way, we help our clients navigate the complexities of insurance, providing expert advice to ensure they are fully protected at all times.

What is an independent insurance agency?

An independent insurance agency is a business that sells insurance policies from multiple insurance companies, rather than being tied to a single insurer. This allows the agency to offer a wide variety of insurance products (such as home or auto insurance) from different providers, giving clients more options to choose from.

Why should someone purchase insurance through an independent agent?

Benefits of an independent insurance agency include:

- Wide range of options – Independent agencies work with various insurance companies, which means they can offer a broader selection of policies and coverage options. This allows them to tailor insurance packages to meet the specific needs and budgets of their clients.

- Personalized service – Independent agents prioritize building long-term relationships with their clients. They take the time to understand each client’s unique needs, providing personalized recommendations and support.

- Local Expertise – Often deeply rooted in the community, independent agencies understand local risks and regulations, which helps them provide relevant and effective insurance solutions.

- Objective advice – Since they are not tied to a single insurance company, independent agents can offer unbiased recommendations. They can compare policies across different insurers to find the best coverage at the best price for their clients.

- Advocacy during a claim – Independent agencies advocate for their clients, helping them navigate the claims process and ensuring they receive a fair settlement. This support can be invaluable during stressful situations like accidents or disasters.

- Ongoing Relationship – Independent agents continue to support their clients as their insurance needs evolve, whether it’s updating policies, adding new coverage, or shopping for better rates.

- Cost-Effective – By having access to multiple insurers, independent agents can shop around to find competitive rates, often saving their clients money while still providing quality coverage.

- Convenience – Clients can manage all their insurance needs through a single independent agency, making Nightlight a one-stop-shop. It’s much easier to handle multiple policies and ensure comprehensive coverage across different areas of a client’s life or business.

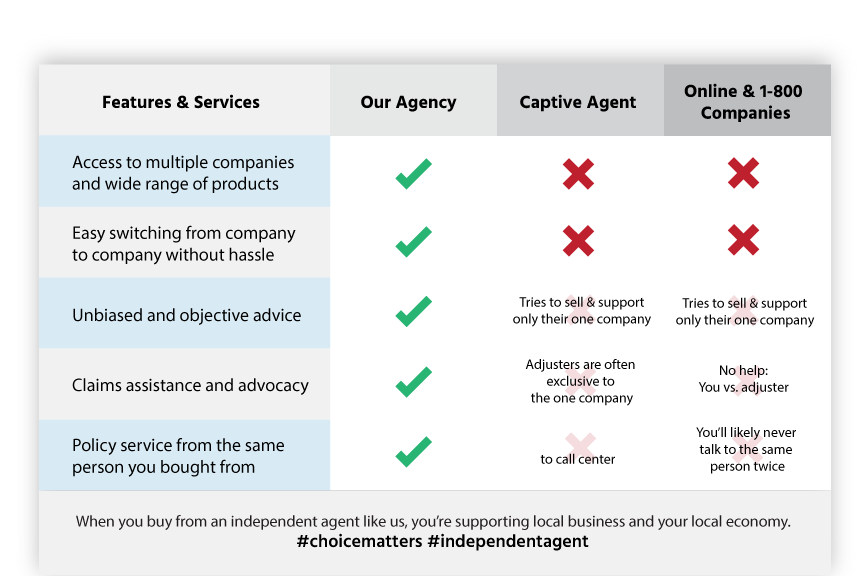

How is an independent insurance agency different?

Unlike a captive, or direct, insurance company who only offers their own proprietary products, our agency is 100% independent of any one company. When it comes to something as important as insurance, it’s imperative that you work with an agency who has an in-depth knowledge of multiple insurance products, companies, and guidelines — not just one.

What separates one agent from another is their ability to proactively service their policy holders, and their knowledge of the insurance industry, products, and different situations that may present themselves to their clients.